Why Intuit's MailChimp Acquisition is a Gift to Accountants

If you're like me when you saw this one come across your feed you thought, what business does Intuit have acquiring an email marketing tool?

I'm an accountant so I'm prone to speculation, particularly if it's something that could disrupt a tool I'm heavily reliant upon. So how does email marketing fit into Intuit's strategy?

Intuit's Past Acquisitions

Let's look at Intuit's most recent acquisitions:

- Mint (2009) The personal finance platform is now a core part of Intuit's personal financial products, and makes a lot of sense in the interplay with TurboTax.

- Good April (2013) Online tax planning software, at a time when TurboTax only helped you with last year's taxes.

- Check (2014) A bill payment mobile app, and you could see this as a logical extension of Mint or QBO.

- Invitco (2014) This company was among the world's first to build a product around PDF data extraction.

- Acrede (2014) A cloud payroll platform for UK small businesses.

- Playbook HR (2015) A platform to manage onboarding & compliance of contractors.

- Bankstream (2017) A banking feed service for banks in the UK.

- TSheets (2017) Online time cards & project time and expense tracking.

- TradeGecko (2020) Cloud-based inventory management software.

- Credit Karma (2020) A free credit score tracking service with 110 million members.

- OneSaaS (2021) A service that integrates e-commerce data from various platforms into QBO.

Each of these acquisitions have very clear connections to existing Intuit products. But email marketing? I still wasn't seeing it.

Until I saw Jeremy Wells' tweet:

This won’t be popular (not much I say is), but I’m bullish on QBO + MC.

— Jeremy Wells, PhD, EA (@JWellsCFO) September 14, 2021

Most think of MC as email, but Intuit sees it for e-commerce. Big players—Stripe, Shopify—don’t integrate with QBO’s GL well.

The acquisition makes a seamless connection between online POS & GL possible.

QuickBooks - The Next E-Commerce Giant?

This seemed odd initially - an accounting ledger getting into e-commerce, until I had this realization:

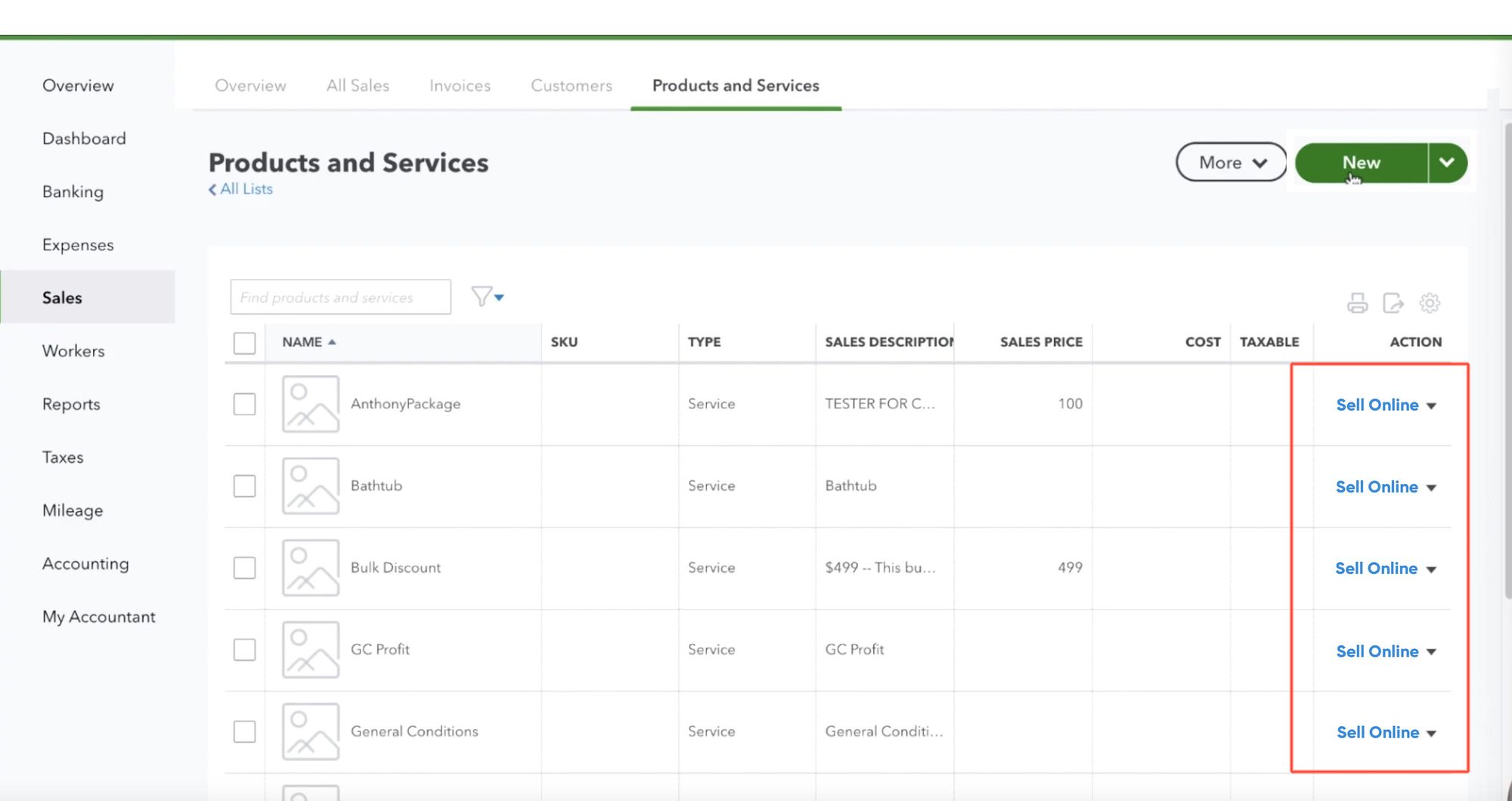

QuickBooks knows all your products. So, just, add a sell online button:

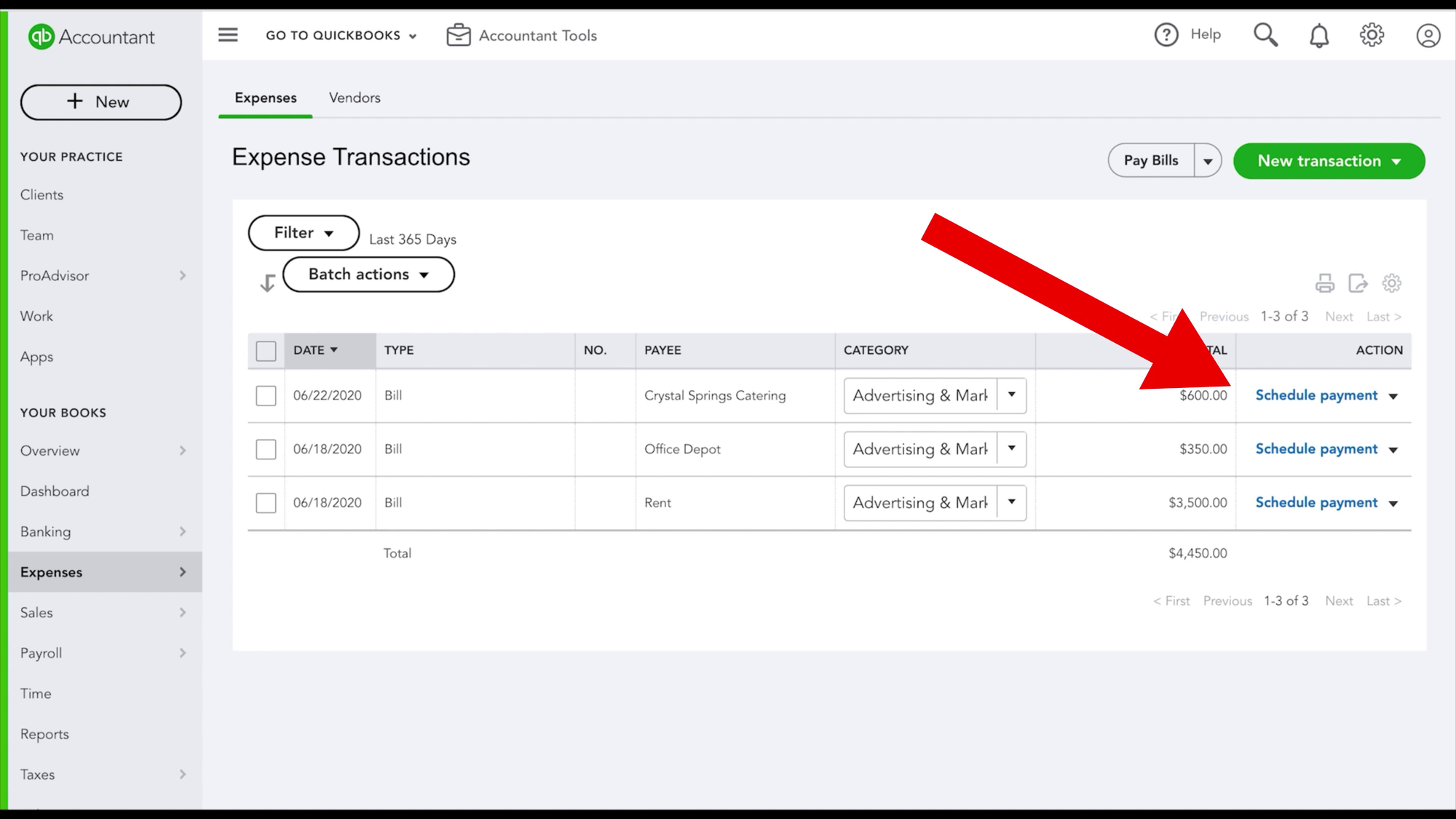

Similar to how they've integrated Melio into their Expenses screen, a frictionless way to start selling online will almost certainly increase conversions for MailChimp.

COVID taught us e-commerce is still just getting started. There was a time when there were e-commerce companies, and there were regular companies. In the near future we'll all be e-commerce companies in some capacity. It's a great advisory opportunity for accountants working with small businesses, and one that could be made a whole lot easier if QBO has a simple embedded solution.

One Tool to Rule Them All

But is this something you want from your accounting ledger? Many of the arguments surrounding cloud accounting, and how you feel about Intuit's dominance boils down to one question:

- Do you want a single tool to do everything for you

- Or a stack of best=of-breed tools to integrate with each other

I ran a poll on Twitter to this end and the results surprised me. 60% said in today's app ecosystem, they want a stack of tools to integrate.

But when your ledger software makes horizontal acquisitions you have an inevitable conflict of interest: if they go into the business of X, what incentive do they have to integrate with other providers of X?

So while it's in Intuit's best interest to acquire Mailchimp, is it in the accounting profession's best interest? The last thing anyone wants is to not be able to bring your own e-commerce solution to QBO.

Melio's Story

Whether Intuit plays hardball on this is anyone's guess, but the best historical point of reference may be Intuit's partnership with Melio.

Melio launched in 2018 and very quickly became a favorite bill pay solution among accountants. It was the simple to use, pared-back bill pay solution we needed when tools like Bill.com were overkill.

In May of 2020 QuickBooks announced an embedded integration with Melio unlike anything we had seen before. QBO users could now pay bills in-app, without ever leaving QBO, courtesy of a tailored version of Melio's bill pay experience.

It works well, and it makes complete sense. So much sense that it almost seems like it ought to be a core function of accounting software.

But a deep partnership like this, or horizontal acquisitions like we're seeing here with MailChimp raises two potential issues: You don't want to force QBO users into using Melia, and you don't want to force Melio users into using QBO.

So today you can bring any other bill pay solution to QBO as long as that bill pay solution has built out an integration with QBO. Since Intuit partnered with Melio, has it been any harder to bring bill.com or something else to QBO? Not that I've heard, but if you've experienced otherwise please let me know.

The second group of users we have to consider are those that want to use Melio with their clients regardless of their accounting platform of choice, and this is the group that may be frustrated with the Intuit partnership right now.

To date, Melio has taken over $500M in funding at a $4B valuation. But if you want them to integrate with anything besides QuickBooks Online, well, they're working on it. Specifically, they're working on an integration for QuickBooks Desktop, but any other integration is further off.

So you've taken $500M in funding, you've been around for three years, and, you haven't gotten to building an integration for anyone else? I've heard them provide various reasons for why, but none that are particularly convincing, and none that seem as compelling as the fact they have a partnership with Intuit, and Intuit probably doesn't want them integrating with other platforms.

MailChimp's Impact on the Ecosystem

So if you have e-commerce clients, of course you don't want to have to use MailChimp if you're using QBO. I won't be surprised if there may be the equivalent of an embedded e-commerce experience in QBO that's backed by MailChimp, but at the end of the day that still doesn't keep you from bringing your own e-commerce tool to QBO, and it's the responsibility of your e-commerce tool to build a solid integration with QBO.

The more complicated scenario could be the second one - MailChimp users who want to bring their own accounting ledger to MailChimp. If Intuit's running MailChimp, and it's the responsibility of the e-commerce tool to build an integration with ledger software, QBO Xero or otherwise, why would Intuit bother building out support for anything but Intuit products?

This is the current pain point with Melio: it's a great tool but it won't integrate with anyone else. So if there's a set of users that comes off worst in this acquisition I don't think it's QBO diehards, because e-comm developers can still integrate with QBO, it's MailChimp users because why would Intuit integrate MailChimp with anything else?

Intuit's Long-Term Strategy

When you're building an integration for QBO you're subject to several sets of rules from Intuit. One is their general "developer requirements," and they start with the following stipulation for your app to be approved:

Your app must solve a problem for Intuit customers. For example, adding new functionality to an existing feature, or creating a faster, easier, or more efficient way of using QuickBooks.

At the end of the day Intuit makes the call on whether your integration is approved. As the definition of what constitutes QBO's 'core product' continues to evolve, will we see Intuit restrict its ecosystem around competing products?

If I'm Gusto for example - Intuit has their own payroll product and today QBO integrates with Gusto because they've agreed to let that integration into their ecosystem. But imagine if tomorrow Intuit snaps their fingers and says, sorry Gusto, we no longer feel this integration solves a problem for our customers because we have an embedded payroll solution.

If QuickBooks continues to evolve into more than an accounting ledger - now it's your payroll software, your bill pay software, potentially your e-commerce software - will it tighten its grip on the ecosystem itself?

.

Where's The Opportunity?

If QuickBooks incorporates MailChimp to be an embedded e-commerce experience, you know the inevitable outcome: your clients think you're an e-commerce expert now. If it's something that in the accounting product, you're expected to be an expert!

And while that may be annoying, it's also a terrific opportunity.

QuickBooks is mainstream. If people see QuickBooks doing something, general awareness will increase massively. Which means whether you like MailChimp or not, whether you're a QBO or Xero user, small businesses are going to be looking at e-commerce like never before.

I mentioned this earlier I think there are two types of accountants: those who specialize in e-commerce, and those who will specialize in e-commerce.

When the cloud accounting ecosystem developed we became champions of the cloud. Not of cloud accounting necessarily but of the entirety of the cloud. The benefits that integrations provide, and the upside of building custom stacks. We had the opportunity to walk clients down that path and many of us are still doing it.

I see e-commerce as a similar opportunity. Most small businesses still aren't selling online but it's a tremendous opportunity for almost all of them. Is it accounting? Does it have anything to do with what we're supposed to be experts in? Absolutely not but here we are.

So - thank you Intuit!

One thing I tell accountants is we all have a distribution problem. Until you've found the best 100 clients out there for you, your problem is distribution, discovery, not learning to do one more thing, but finding the next person who will pay you well to do that thing you already do well.

Your small business clients have the same distribution problem. And if they aren't selling online, they aren't reaching the customers that are out there for them.